Table of Contents Show

Pradhan Mantri Jeevan Jyoti Bima Yojana | PMJJBY

Life insurance policies are better options for securing your survival. Different insurance providers are offering a variety of life insurance options for us to choose over. Each life cover scheme will have its perks and limitations. The life securing contract will have tenure and due amount as per terms and conditions. You can choose the best plan suitable for you by understanding all the aspects of the policies. Pradhan Mantri Jeevan Jyoti Bima Yojana is one of the best life insurance policies you can avail of. You can apply for this contract from any of your savings bank account. This post will brief on the best aspects of the PMJJBY scheme.

About Pradhan Mantri Jeevan Jyoti Bima Yojana

Pradhan Mantri Jeevan Jyoti Bima Yojana is a central government-backed Life insurance scheme in India with the smallest investment of just Rs. 330 per annum. This scheme was announced in the annual budget 2015 & launched by PM Modi on 9 May 2015 in Kolkata. You may apply to any other insurance service provider for the PMJJBY scheme. You can apply for the PMJJBY scheme from any Banking service provider. The security is for a one-year duration, and you can renew the program every year. The program is available in collaboration with banks. All your payments will be processed by “auto-debit” through the participating bank.

Who Can Apply For PMJJBY Scheme?

Candidates satisfying the following eligibility criteria can apply for Pradhan Mantri Jeevan Jyoti Bima Yojana.

- The applicants must be between the age of 18 to 50 years.

- The person applying for PMJJBY should have an operative bank account.

- The applier should have his/her Aadhar card linked with his account.

What Can You Avail From PMJJBY Scheme?

The Pradhan Mantri Jeevan Jyoti Beema Scheme can provide life insurance coverage of 2 lakhs for you.

You can avail of tax benefits to the premium you are paying.

Premium Details

You have to INR 330 per annum for availing life insurance courage of 2 lakhs. A nominee can claim insurance under the sudden dismiss of the applicant.

When Can We Apply for PMJJBY Scheme?

The insurance is for the period of 1st June to 31st May. The scheme will auto-renew every year as the payment mode is “auto-debit” from your account. You can join the plan at any time in the year by paying the full amount of the premium. You have to provide your consent to continue the scheme for the successive year.

Apply Pradhan Mantri Jeevan Jyoti Bima Yojana

You can apply for this PMJJBY scheme through your bank service provider. LIC will process your insurance claim coverage. You have to pay the entire annual premium amount during the year for applying to this scheme.

Rejoining Procedure

You can join again in the scheme by paying the annual premium amount. You will be eligible for claiming life insurance worth 2lakhs after the completion of 45 days from the date of enrollment.

When Will the Policy expire?

Your policy will be rejected under the following circumstances.

- The policy will be automatically closed when the applicant attains 55 years of age.

- You should ensure that your bank statement has sufficient funds to pay the annual premium. Failing to maintain money in the account for premium payment may need the closure of the life insurance policy.

- The policy will expire when the candidate has more than one PMJJBY life insurance policy.

How to Make Your Claim for Pradhan Mantri Jeevan Jyoti Bima Yojana?

The appointee can claim the life insurance in case of the death of the PMJJBY scheme applicant. You can use the following steps for claiming life insurance.

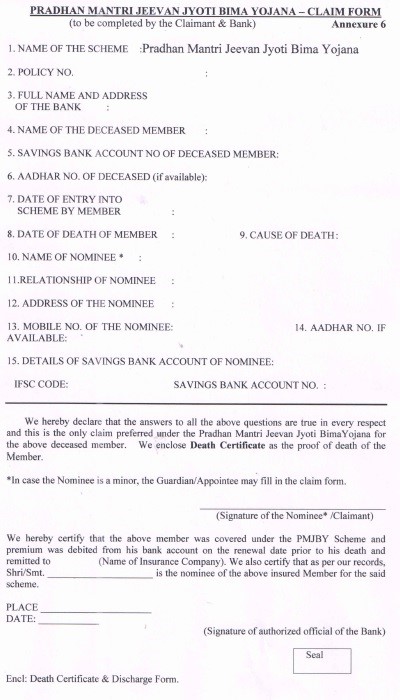

Step 1: Approach the policy-providing bank with the death certificate of the applicant

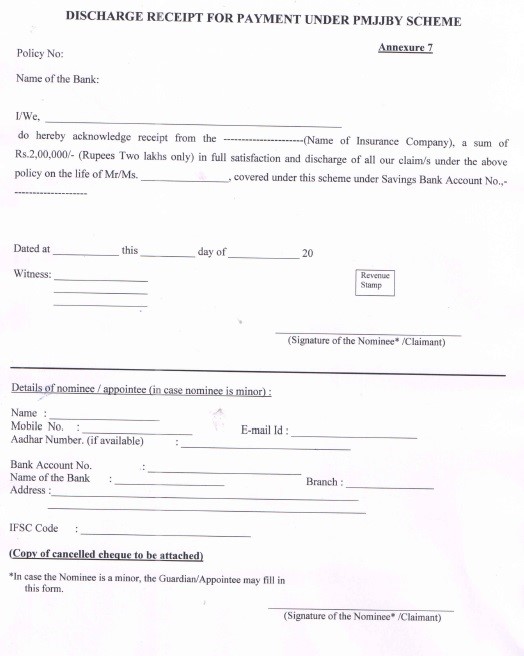

Step 2: Obtain the claim form and discharge form from the insurance providing bank.

Step 3: Fill in both the form and submit it to the bank.

Step 4: Submit the death certificate of the policyholder and canceled cheque of the applier.

Step 5: Your claim will be initiated, and the same will be credited to your bank account.

Claim Proceedings by the Bank

The bank will process your claim application with the following procedure.

- The bank will check the eligibility of the claim application by verifying all the documents submitted.

- Your claim form details and nominee information of the policy will be cross-verified.

- After verifying all the credentials, the bank will complete its part in the claim form and discharge receipt.

- The bank will then forward the completed form and canceled cheque to the LIC office for further processing.

Claim Proceedings by the Pension and Group Schemes Unit of LIC

The LIC will proceed with your claim request with the following steps.

- The LIC will ensure the suitability of your claim form for processing.

- The P&GS unit will then confirm that your policy is active and no prior death claim was made. If any discrepancy is found it will be intimated to the nominee.

- After making sure of the eligibility of the claim, the insurance fund will be transferred to the bank account of the Nominee.